Home Improvement Deductions 2025 Form. Here are eight ways you can claim a tax deduction or tax credit for home improvements: A tax credit directly reduces the tax amount you owe. Credits and deductions under the inflation reduction act of 2025.

The residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2025.

Interest that is payable on loans taken for home improvement are tax deductible up to rs.30,000 per annum.

7 Home Improvement Tax Deductions for Your House YouTube, 5 ways to save in. Lets you get to house hunting sooner.

Best Tax Deductions Form Fill Out And Sign Printable Pdf Template, The standard deduction for single filers rose to $13,850 for 2025, up $900; Why you can trust us.

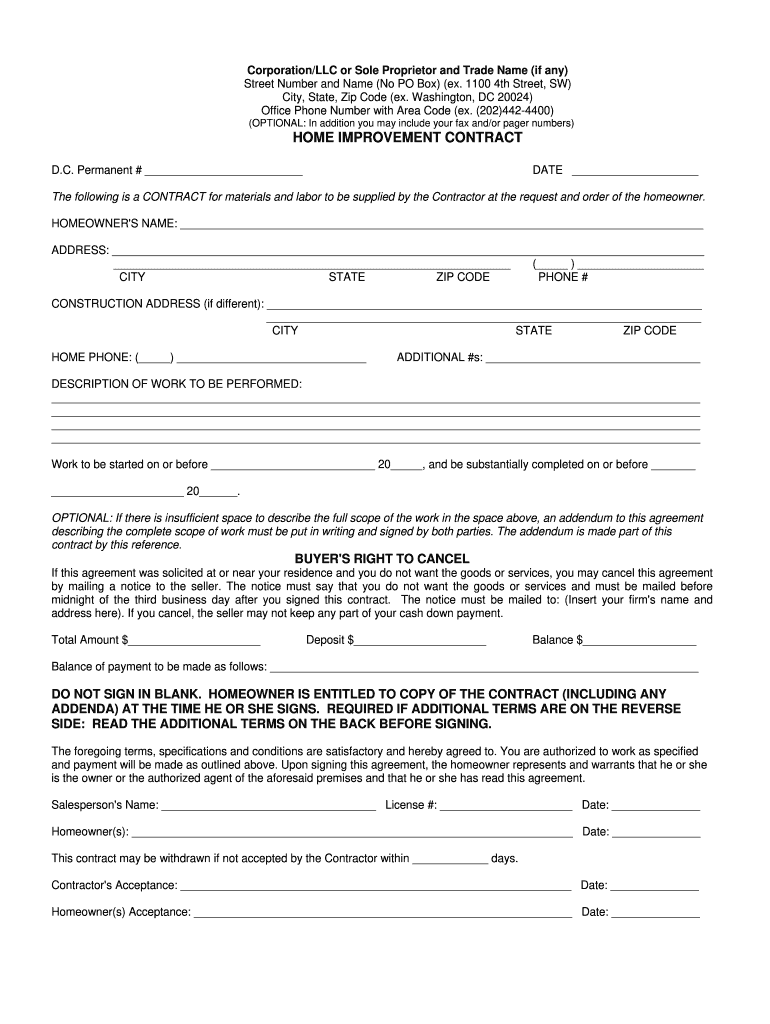

Washington Home Improvement Contract Form Fill Out and Sign Printable, The residential energy credits are: Two types of home improvements typically offer some tax benefits:

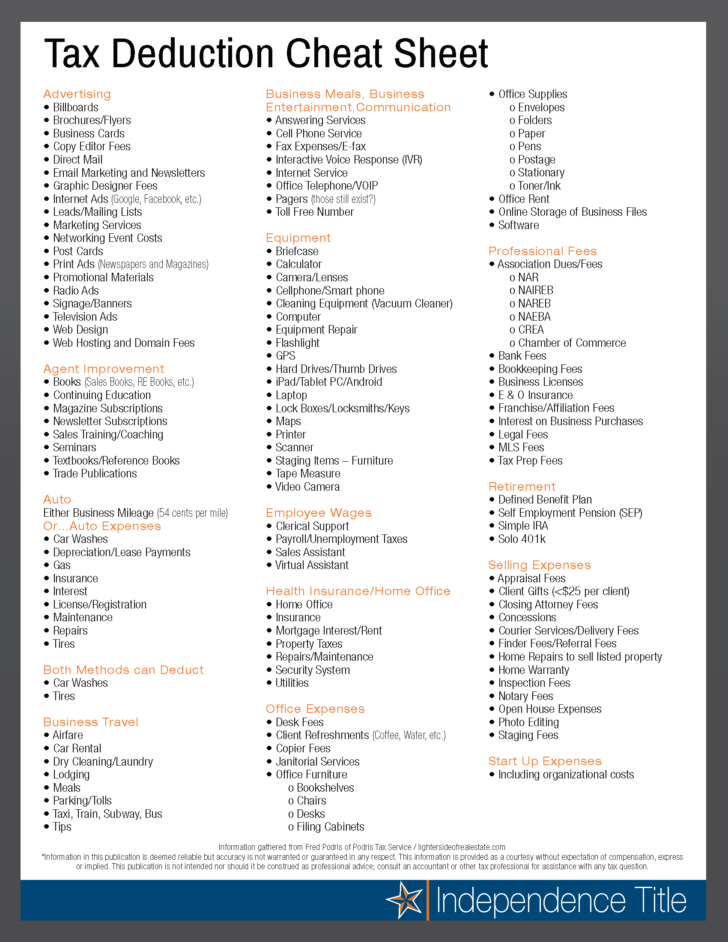

Printable Tax Deduction Worksheet —, Presidential address to the federal assembly. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2025.

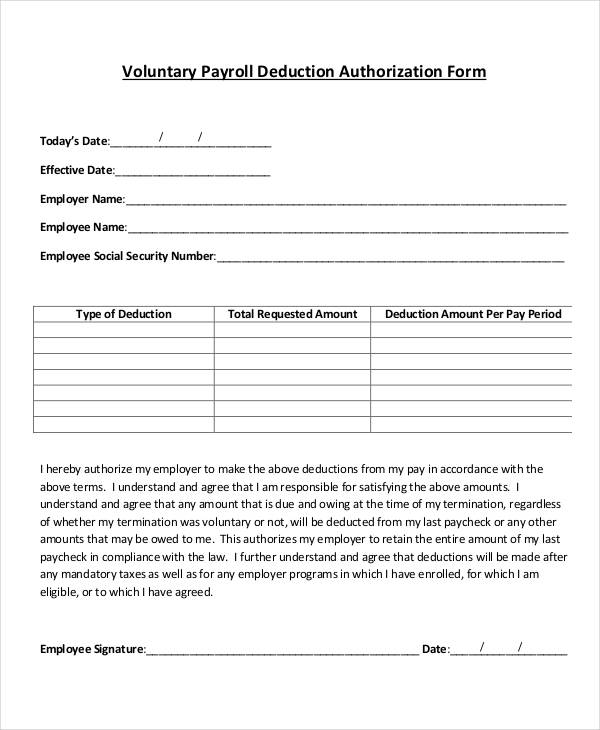

Payroll Deduction Form Free Payslip Templates, Why you can trust us. To deduct your mortgage interest, you'll need to fill out irs form 1098, which you should receive from your lender in early 2025.

Tax time, already? 2025 tax deductions for homeowners + a COVID rebate, These forms have undergone a few. The residential energy credits are:

7 Home Improvement Tax Deductions [INFOGRAPHIC] [Video] [Video] Tax, The standard deduction for single filers rose to $13,850 for 2025, up $900; What home improvements are tax deductible?

![7 Home Improvement Tax Deductions [INFOGRAPHIC] [Video] [Video] Tax](https://i.pinimg.com/736x/24/91/0b/24910b36cb01204858c46fd5ae58d17c.jpg)

What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform, If you made changes to your home in 2025 or are planning to make improvements, you might be able to save on. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2025.

Itemized Deductions Form 1040 Schedule A Free Download Worksheet, After determining how much overall taxes are due, a tax credit lowers that dollar amount at a. When you make a home improvement, such as installing central air conditioning or replacing the roof, you can't deduct the cost in the year you spend the.

Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2025.

Proudly powered by WordPress | Theme: Newses by Themeansar.