Employer Max Contribution 401k 2025. For 2025, the irs allows you to contribute up to $23,000 to your 401 (k) at work and up to $7,000 to your ira. 401 (k) contribution limits in 2025 and 2025.

401k Employer Contribution Deadline 2025 Lotta Diannne, Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025. Here's what you need to know about that maximum, employer matches and how much you should contribute to maximize your retirement savings.

401k Employee Contribution Limits 2025 Storm Emmeline, Max 401k contribution 2025 including employer. The 401 (k) contribution limit for 2025 is $23,000.

What Is The Maximum Amount Of 401k Contribution For 2025 Emili Janessa, For 2025, the contribution limits for 401 (k) plans have been increased. Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

401k Max Contribution 2025 Include Employer Match Nelie Joceline, For 2025, the irs allows you to contribute up to $23,000 to your 401 (k) at work and up to $7,000 to your ira. The contribution limit for 401 (k)s, 403 (b)s, most 457 plans and the federal government's thrift savings plan is $23,000 for 2025, up from $22,500 in 2025.

401k 2025 Contribution Limit Chart, Here's what you need to know about that maximum, employer matches and how much you should contribute to maximize your retirement savings. Here's what you need to know about that maximum, employer matches and how much you should contribute.

Maximum Employee Contribution To 401k 2025 Roda Virgie, For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2025 401 (k) limit of $22,500. Those 50 and older can contribute an additional $7,500.

Max 401k Contribution 2025 Calculator Employer Match Tanya Eulalie, If you contribute, say, $23,000 toward your 401 (k) in 2025 and your employer adds $5,000, you’re still within the irs limits. Those 50 and over can contribute an additional $3,500 for a maximum contribution of.

What Is 401k Max For 2025 Haily Kellsie, In 2025, the contribution limit for a roth 401 (k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older. Learn more about 401 (k) limits.

401k Contribution Limits And Limits (Annual Guide), Employees can invest more money into 401 (k) plans in 2025, with. Employers can contribute to employee.

What Is The Maximum 401k Contribution 2025 Alice Babette, Find out the irs limit on how much you and your employer can contribute to your 401 (k) retirement savings account in 2025 and 2025. In 2025, the contribution limit for a roth 401 (k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older.

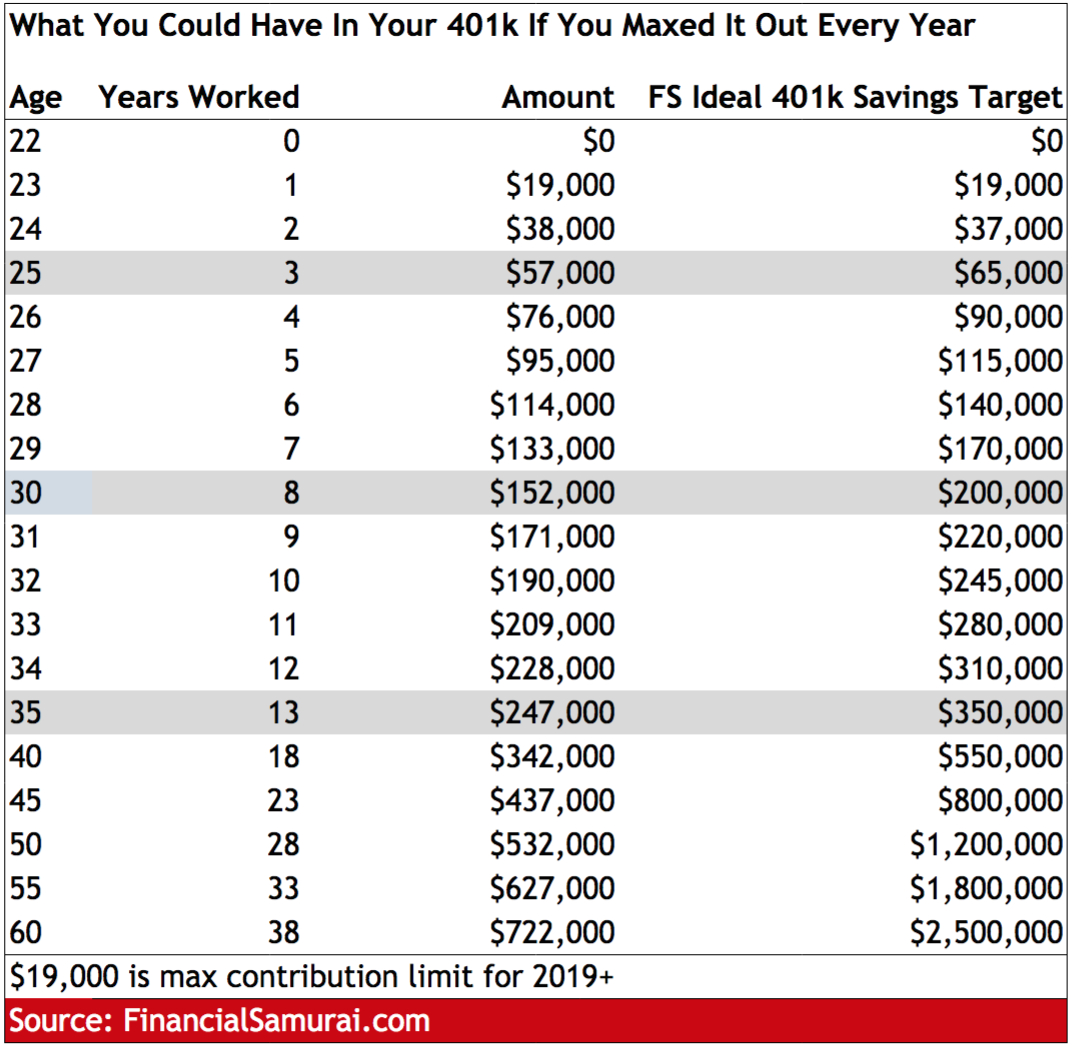

The maximum 401k contribution limit financial samurai, the total maximum allowable contribution to a defined contribution plan (including both employee and employer.

Starting in 2025, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov.